NagaCorp Ltd (HKG:3918) – Recommendation to Accumulate on Dips

- Marvin Choo

- Jan 23, 2019

- 8 min read

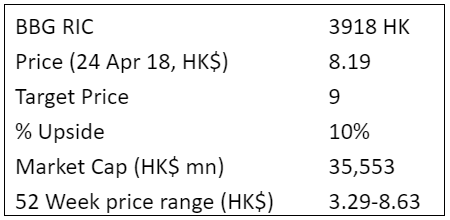

Stock summary:

I recommend accumulating NagaCorp Ltd (HKG: 3918) on dips. The stock price retraced shortly after 1Q FY18 unaudited results were released. The low margin VIP segment missed elevated street estimates and fell 44% QoQ (4Q 2017 VIP volume was boosted by a one-off opening event for Naga2). This was compounded by the recent news that the Chinese government might open up Hainan Island as a gambling hub in the future, fueling negative sentiments among investors.

However, I believe that 1. The long-term growth prospects in all 3 gaming segments, namely VIP market, mass market public floor tables and EGMs remain intact. Mass market and EGM should continue to see solid growth driven by increased tourism while the VIP segment will see new growth opportunities as new junkets open VIP rooms in 2Q 2018. 2. The threat of Hainan Island turning into a gambling hub in the near future is over-emphasised by market, and the risk is in fact, much lower. Hence, I recommend accumulating NagaCorp on dips.

Company background:

NagaCorp is the sole Casino operator in Phnom Penh, with a monopoly license till the year 2035. In November 2017, it increased capacity by approximately 120% by opening a new casino resort, Naga 2, adjacent to its existing NagaWorld Hotel, which was experiencing under-capacity, with utilisation hitting 90%, as announced by management. Situated around key tourist attractions in the capital of Cambodia with no competition within a 200km radius, Naga Corp is in a prime position to continue to reap the benefits of increasing Gross Gaming Revenue (GGR) in the casino industry and increasing tourist numbers that Cambodia is experiencing.

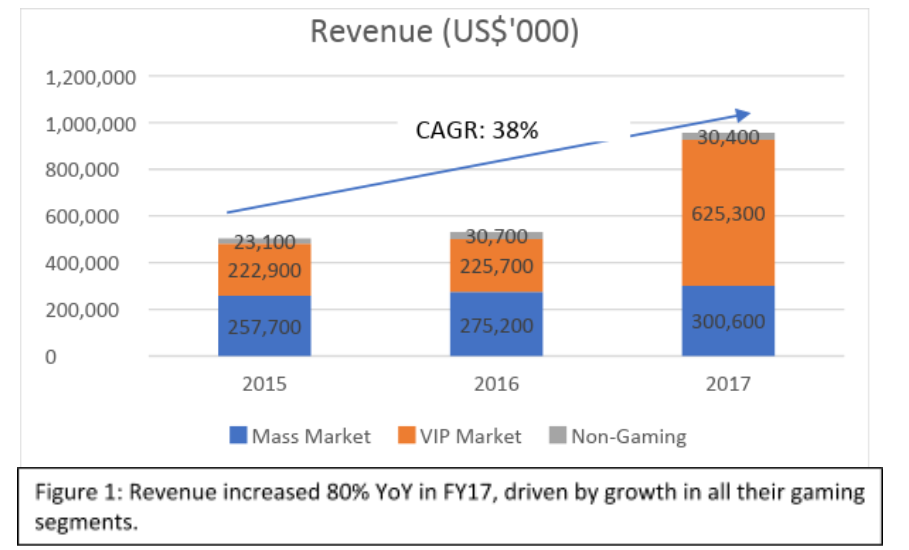

Revenue grew 80% YoY driven by their gaming revenue

NagaCorp operates in 3 segments. VIP market is driven by junkets who bring VIP players to the casino resort and receive major commissions. This segment experienced the greatest growth (177% YoY in FY17) as a result of high net worth players’ increasing appetite to gamble and the opening of Naga 2 in November, which targets VIP players in particular. The mass market segment can be broken down further into public floor tables and electronic gaming machines. This segment saw high single digit growth (9% YoY in FY 17) mainly driven by the increase in tourist visits into Phnom Penh, which increased by 21% YoY. Non-gaming revenue, the smallest contributor remained flat in FY17.

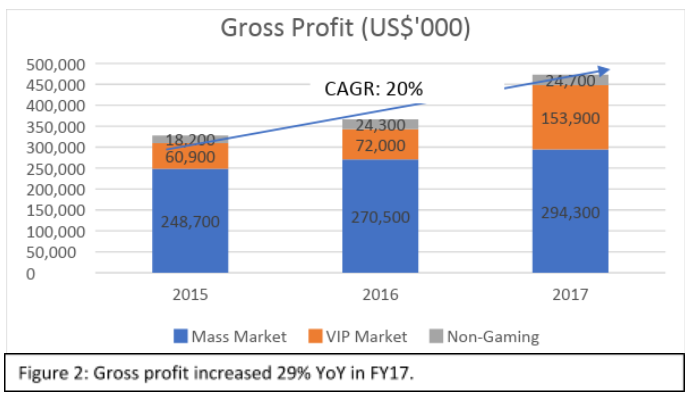

Gross profit grew 29% YoY as VIP margins are lower

As common-sized revenue changed, and the VIP market segment contributed a greater share of revenue (65% in FY17), the overall GPM fell from 69% to 49% as VIP market’s GPM is significantly lower than the mass market and non-gaming segments. This segment has a low gross profit margin as junkets take a cut from the revenue.

Investment thesis:

Growth drivers remain intact

NagaCorp is riding on Phnom Penh’s plan to grow tourism sector

The emergence of the middle class in developing countries around Cambodia i.e, China, Vietnam and Thailand is one of the growth drivers for NagaCorp. Visitation to Cambodia continued to grow with international arrivals increasing by 12% in FY17 to 5.6 million visitors and arrivals at Phnom Penh International Airport growing by 21%. In 2017, 1.2 million Chinese visited Cambodia (up 45% YoY) and Cambodia’s tourism board aims to attract 2 million by 2020 (CAGR 19%). This aim is supported by Cambodia’s China ready strategy such as the increase in Chinese speaking tour guides in order to attract more Chinese tourists. The increase in tourism also stems from growing number of airlines operating international flights to Cambodia. As NagaWorld and Naga 2 are situated near many tourist attractions, headcount at the hotels grew. With a larger headcount, mass market volume is poised to grow. This is reflected in the growth in 1Q mass market volume, where mass tables buy-ins increased 19.1% QoQ, while EGM bills in increased 2,8% QoQ.

Furthermore, the increase in tourism seems to be gaining extra momentum in FY18 as economies in Asia continue to flourish, coupled by the fact that the capital of Cambodia is getting more connected to other parts of the world. VINCI airports, Phnom Penh’s airport operator, revealed that passenger traffic at Phnom Penh airport increased 34.5% YoY in 1Q 18. This can be attributed to new services introduced by 3 carriers and increasing services provided by Chinese carriers into the city this year.

As tourism continues to grow, more developers are willing to invest into developing infrastructure. A local developer, WorldBridge Group, is currently constructing a new integrated leisure and entertainment complex called WB Arena on the Bassac River south of Phnom Penh targeting tourists. It is slated to open at the end of 2018. These developments will continue to attract new tourists into the country, supporting the long term tourist growth plan.

Naga2 yet to ramp-up fully; High margin mass-market continued solid growth in 1Q;

The recent price correction could be attributed to the 44% fall in VIP business in 1Q. First quarter is seasonally slower in Cambodia and actually has a negative impact from Chinese New Year (the opposite of Macau). In addition, the 212% increase in VIP business in 4Q FY17 was front-end loaded. However, I believe that with Suncity, the largest Macau junket opening rooms in March 18, and another junket, Meg-Star, unveiling its rooms in 2Q, VIP business will see better numbers going forward as Naga2 continues to ramp up its operations. I believe that the recent price correction was over-done, as VIP market has a slow ‘win rate’, meaning a small percentage of rollings (2.7%) are converted into revenue, and low GPM as compared to mass market, which has a higher ‘win rate’ (20%) and GPM. As a result, the solid growth momentum in the volume of high margin mass market will more than offset a one-off decrease in VIP market volume.

High margin-mass market continued on its growth trajectory, with mass table buy ins increasing 56% YoY and EGM bill ins increasing 24% YoY. With initial growth drivers intact, as well as the new drivers with more carriers travelling to Phnom Penh, I believe that the segment has the potential to outperform estimates.

GGR continues its climb back towards its historical peak

The Macau GGR bottomed out in mid 2016 after the Chinese government’s crackdown on corruption and campaign against shows of wealth among public officials that negatively affected the casino industry. Macau’s Gaming Inspection and Coordination bureau reported that gaming revenue increased 19% YoY in 2017 to $33.13 billion, and most recent April 18 data suggests that the Macau market is heading for a year-over-year growth of 20-21%. Most recently, banking group Morgan Stanley raised its 2018 estimates for Macau wide mass market GGR by 3 percentage points to 15%. As demand for gambling continues on its road to recovery, NagaCorp is situated optimally to ride this trend and satiate gamers’ appetite for entertainment in Cambodia.

Press’ over-emphasis of the Hainan threat

At the recent Boao Forum, China unveiled its plans to further develop Hainan Island, a Southern province, through the development of horse racing and other projects including beach and water sports. China hopes that one day, it could become the Las Vegas of China. In addition, it said that it will “explore the development of sports lottery and instant lottery on large-scale international games”, igniting fears that it could open up its doors to casino operators in the near future, and affecting NagaCorp due to its close proximity to Cambodia. Speculation stoked fear as it was reported that it will take only a month for casinos to become operational in Hainan with all the infrastructure already in place. However, no concrete plans and timeline has been made and I believe that in the near future, this speculation is inflated due to news headlines.

Ambitious goals to expand internationally

The group’s ambitious goals of expanding internationally is coming to fruition with the construction of Naga Vladivostok in the Primorsky Krai Integrated Entertainment Zone, one of the five Russian regions where casino gambling is permitted. Russia aims to transform the Primorsky area into its version of Las Vegas or Macau. The coming eleven-story integrated casino resort is expected to open in FY19 with a multi-purpose concert hall. This supports management’s plan to continue developing casino resorts closer to the Northern parts of China, where Macau’s penetration rate is lower. I believe that this supports NagaCorp’s long term expansion plans.

Catalysts:

VIP volume could outperform with current dampened confidence

With junkets ramping up VIP volumes with the opening of Naga2, which is catered towards the VIP segment, I believe that this segment still has a lot of steam to grow further. Suncity, Macau’s biggest junket, opened rooms in March 2018 to cater to VIP players in Naga2. As it ramps up operations to attract more VIP players to the resort, NagaCorp’s VIP segment volume has many upsides. In addition, another Macau junket, Meg-Star will start operating in 2Q FY18. I believe that it could take a while for Naga2 to reach its full capacity, but with many new junkets tying up deals with the group, I believe that it will outperform street’s lowered expectation.

Cambodia tourism growth story to continue

I believe that with Cambodia’s government supporting tourist growth, coupled by the increase in investments by private companies to attract new tourists, the capital will be able to bring in more tourists. This will continue to drive the mass market segment, and both top line and bottom line will grow significantly, with the mass market segment having the highest ‘win rate’ and GPM.

Fear of the Hainan threat will die down

I believe that when market appreciates the fact that it will take some time for China to even consider issuing casino licenses to hotel operators on Hainan Island, the stock will see a revaluation upwards.

Valuation:

Using unaudited segmental breakdown of the rolling volume in 1Q FY18, I managed to come up with a conservative prediction of NagaCorp’s FY18 net income using certain key assumptions. Key assumptions are as follows:

1. Being extremely conservative, I assumed that all 3 gaming segment volumes do not grow from 1Q FY18. (From the numbers in figure 6, it can be seen that the volumes are in fact increasing QoQ, except for the VIP segment which saw a decline due to one-offs in 4Q17).

2. Used historical segmental ‘win rate’ and GPM from 2H 2017 to come up with my GP predictions, from volume that I have predicted. My gross profit prediction is approximately US$557mil, which is a 17.7% growth YoY.

3. Assuming operating expenses grow more than proportionately compared to the growth in revenue, I assume that operating expense margins grows, and net income grows to US$293mil, which is 15% higher than FY17. EPS will be HK$0.53, while current street consensus is HK$0.56. However, it is important to note that this is a conservative estimate. Using my own net income predictions, PE (FY18) is 15.8x. This is a huge discount to its Macau counterparts which are trading at a much higher valuation (which is rational since investing in Cambodia has its own risks).

Investment risks:

A sudden downturn in GGR as demand could be cyclical

A sudden change in consumer’s appetite to gamble as an entertainment will affect all gaming segments, affecting earnings and sparking a revaluation of the stocks of casino operators. This is the biggest investment risk as it is difficult to predict accurately consumer patterns for consumption.

Tourism growth rate might slow down

Cambodia might not be continue to attract more tourists. Certain scenarios such as an economic downturn or a change in consumer preferences in travelling could hamper the growth rate. This could affect the mass-market segment’s topline to a large extent.

Chinese government crackdown on capital outflows

The government could restrict capital outflows by cracking down on the ultra-rich in China or develop Hainan Island into a gaming hub with Chinese casino operators running the resorts. This risk is small as I believe that China supports the growth of Macau, and capital outflow into Cambodia’s gaming industry is minute compared to their entire GDP.

Comments